Proving your shared finances is one of the most important parts of an Australian Partner visa application, and it’s something many couples find confusing. The goal is to show that you and your partner genuinely share financial responsibilities, not just through joint accounts, but in the way you manage your lives together.

In this guide, you’ll learn exactly which financial documents matter most, how to present your evidence clearly and convincingly, and the practical steps that make your case stronger. Drawing on 45+ years of immigration experience, including 25+ years working with Australia’s Department of Immigration, I’ll share what assessors look for and how to make your financial story shine.

Key Takeaways:

- Financial evidence is one of four key areas decision-makers use to assess partner visa relationships.

- The Department looks for financial interdependence and signs of mutual commitment through shared spending, transfers and joint responsibilities.

- Joint accounts help but are not required; other evidence can show you function as an economic unit.

- Quality evidence that tells your financial story matters more than piles of random documents.

- Modern and cultural variations in money management are accepted; be honest and explain how your arrangements work.

- A timeline showing growing financial commitment and clear explanatory statements makes documents easier to assess.

- Professional guidance can help you present the most relevant documents; I often point clients to evidence assessors value.

Showing shared finances can feel confusing, but you don’t have to work it out alone. With more than 45 years of immigration experience, Carlos Sellanes and the team at Sellanes Clark Immigration Law Specialists know exactly what the Department is looking for. Visit our website to see how we can help you present your financial evidence clearly and confidently.

Types of Financial Evidence

You need clear documents that show you share money or support each other. The Migration Regulations consider financial aspects as one of four key areas decision makers look at, so your evidence should tell a simple, consistent story.

I group the most useful evidence into five practical categories below. Each row shows the type and concrete examples you can collect.

| Joint bank accounts | Statements with both names, joint deposits, shared card transactions, 6–12 months of activity |

| Individual accounts & shared expenses | Regular transfers between partners, rent payments, split bill records, annotated transaction histories |

| Shared bills, rent or mortgage | Lease agreements, joint utility bills, rates notices, mortgage statements showing both names |

| Loans, mortgages, assets | Joint loan contracts, title deeds, payment schedules, evidence of shared purchases like a car |

| Financial support & transfers | Regular bank transfers, remittance receipts, gift records, proof of partner paying household costs |

- Collect at least 6–12 months of statements when you can.

- Label or annotate transactions so an assessor can follow them.

- Use receipts, invoices and leases to back up bank entries.

- Get short statutory declarations from witnesses if a document is informal.

- Include a plain cover letter explaining any unusual arrangements.

Joint Accounts

Joint accounts are strong, visible evidence. A joint savings or transaction account in both names shows you pool resources and pay household costs from the same place.

You should provide bank statements that show regular activity. Look for shared payments like rent, groceries and utilities. I often see assessors respond well when statements show both names, repeated joint transactions, and consistent balances over time.

Individual Accounts and Shared Expenses

Separate accounts do not hurt your case if you can prove you share costs. Regular transfers for rent or bills, split payments and reimbursements recorded over months show financial interdependence.

Gather at least 6–12 months of transaction histories that show these patterns. Add a short spreadsheet that explains each recurring transfer, with dates and amounts, and attach receipts or bills as proof.

Make it easy for the assessor: highlight monthly transfers like $800 rent contributions, standing orders for $120 utility shares, or large joint purchases where one partner paid and the other reimbursed. I advise you to include a brief cover letter that explains why you use separate accounts and how you split expenses.

Perceiving your financial story clearly will make the difference for an assessor reviewing your application.

Important Tips for Gathering Evidence

Focus on quality, not quantity. A few clear documents that show how you pay bills, share costs, or support each other will speak louder than a pile of unrelated papers. Keep dates visible and link each item to a part of your relationship timeline so an assessor can see how your financial life developed over time.

- Joint bank statements showing regular joint spending or transfers.

- Shared bills and utilities in both names, or receipts showing consistent contributions.

- Lease or mortgage documents that list both partners, or rent receipts and bond lodgements.

- Evidence of shared assets (car registration, property titles) or liabilities (joint loans).

- Records of formal financial support—regular transfers, money sent for household expenses.

- Insurance or superannuation beneficiary nominations that name your partner.

- Clear explanatory statements that tell the story behind non-traditional arrangements.

This makes it easy for the assessor to follow your financial story and see you as an economic unit.

What to Include

Collect bank statements for the period you lived together or for the last 6–12 months if that better shows your pattern. Include both joint and personal accounts when transactions show shared spending or transfers between you. I often ask clients to highlight specific transactions and add a one-line note explaining each transfer.

Also include proof of shared bills, rent or mortgage payments, and big shared purchases like a car or furniture. Don’t forget smaller but regular items: grocery transfers, petrol top-ups, or subscription payments in one partner’s name that you both use. Add any legal documents that show financial ties, such as wills or joint loan contracts.

Organizing Your Documents

Label everything and create a short index at the front. Use simple file names like “Bank_Joint_2024-01_to_2024-06.pdf” and group documents by type: bank accounts, bills, loans, assets, and payments. Make a one-page summary that lists each document, the date range, and why it matters to your financial story.

Number each item and cross-reference it in your summary. For example, put “Exhibit 3” next to a bank transfer and the same label in your summary line: “Exhibit 3 – $400 weekly transfer from Partner A to Partner B for household bills.” This helps assessors quickly match your written story to supporting documents.

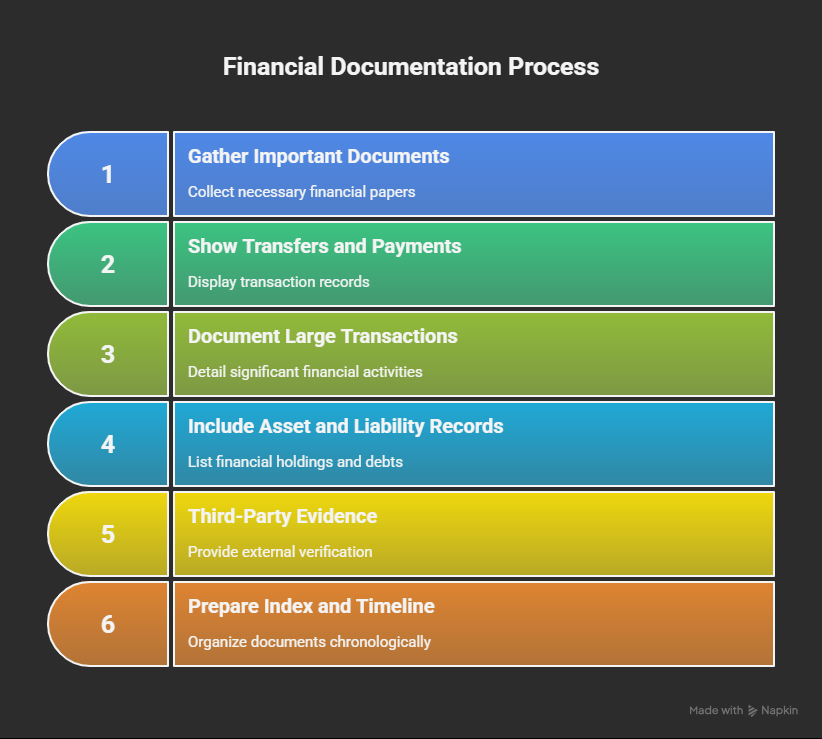

Step-by-Step Guide to Presenting Your Financial Situation

Start by telling a clear financial story across dates, accounts and receipts. You should show how money flowed between you two over time — joint accounts, transfers, shared bills, large purchases and any regular financial support. Aim to provide at least 6–12 months of bank statements for each account that matters, plus receipts or invoices for big shared items like a car or furniture.

Organise documents so an assessor can read your story quickly. Use a short index, label documents by date, and add tabs for categories like “joint accounts”, “rent/mortgage”, “shared bills” and “support payments”. I find assessors respond well to a one‑page summary that lists the key documents and what each proves.

| Gather important documents | Collect 6–12 months of bank statements, joint account records, rent or mortgage statements, utility bills, invoices and receipts that show shared spending. |

| Show transfers and payments | Highlight regular transfers between you, evidence of one partner paying the other, and records of who paid shared bills like electricity or internet. |

| Document large transactions | Include contracts, invoices or receipts for large purchases bought for the household, such as a car or furniture, with proof of payment. |

| Include asset and liability records | Provide title deeds, loan statements, vehicle registrations and insurance policies that list either or both partners. These show joint economic ties. |

| Third‑party evidence | Get brief statements from landlords, accountants or service providers confirming shared arrangements, paid rent, or joint leases. |

| Prepare an index and timeline | Make a one‑page index and a simple timeline that shows when accounts opened, when major shared expenses occurred, and how contributions changed. |

Preparing Your Application

Start by making a checklist of documents you already have and those you need to get. For example, gather 12 months of statements for any joint account, plus 6 months for individual accounts that show transfers. Also include receipts for joint purchases over $1,000, rent ledgers covering the last year, and utility bills with both names where possible.

Next, create a short folder or PDF with a cover index. Label each document with the date and a one‑line note saying what it proves. I often ask clients to add a one‑page summary that lists the most persuasive items and why they matter. Keep copies and highlight the transactions you reference in your explanatory statement.

Writing Explanatory Statements

Write plain statements that explain unusual or non‑traditional arrangements. Tell a short timeline: when you opened a joint account, when you began contributing to rent, or when one partner started sending regular support. Use specific dates and amounts, for example, “From 1 March 2022 to 30 June 2023, Partner A transferred $500 AUD monthly to the joint account for groceries and bills.”

Be honest and concise. If you keep separate accounts for cultural or practical reasons, explain how you still share expenses. Attach bank screenshots, transfer records and copies of bills that match each sentence in your statement. Sign and date the statement, and have your partner sign a matching statement.

Structure each explanatory statement with a short heading, a clear timeline, specifics about who pays what, and a list of supporting documents referenced by page number. For example: “Timeline: opened joint account 10/05/2021; Contributions: Partner B transferred $800 AUD on the 1st of each month; Evidence: joint account statements pages 3–8, rent receipts pages 9–11.”

Financial evidence is one of the most common areas where partner visa applications fall short. If you want expert guidance shaped by decades inside Australia’s Department of Immigration, Sellanes Clark Immigration Law Specialists can help you strengthen your relationship proof and avoid costly mistakes. Visit our website and learn how we support partner visa applicants every day.

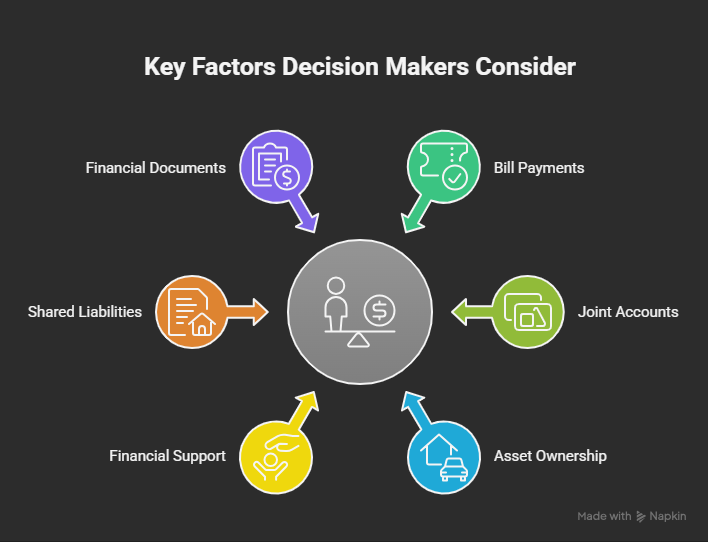

Key Factors Decision Makers Consider

Assessors look at more than bank statements. They want to see whether you and your partner act as an economic unit. Evidence that shows regular sharing, mutual support and joint decision-making is what carries weight. The Migration Regulations consider financial aspects as one of four key areas used to assess genuine relationships.

Typical factors include the pattern of payments, the ownership of major assets, and whether you support each other financially during hard times. Concrete examples often help: a joint lease showing both names for 12 months, regular transfers labelled “rent” on bank records, or a shared mortgage with repayments made by both partners.

- Who pays household bills and how often

- Existence of joint bank accounts or shared card use

- Joint ownership of property, cars or other major assets

- Regular financial support when one partner has no income

- Shared liabilities like loans or mortgages

- Written budgets, household agreements, or financial statements

Perceiving how these pieces fit together helps assessors decide if your finances are genuinely shared.

Financial Interdependence

You want to show patterns, not just one-off payments. Regular transactions tell a story. For example, monthly transfers of $500 for groceries, a joint rent contribution of $1,200 every month, or both names on a utility bill for 18 months. These repeat items are easier for decision makers to understand.

Include a mix of documents. Bank statements that show regular transfers, a lease or mortgage with both names, bills in both your names, and evidence of shared bills paid from one partner’s account all help. I often recommend a short table that links each document to the expense it proves as that makes your case clearer.

Genuine Commitment

Financial ties can show emotional and long-term commitment. Joint investments, a shared superannuation beneficiary form, or one partner paying medical bills for the other are strong signs. For instance, I once saw a file where joint mortgage repayments over 24 months and a shared loan for a car convinced the assessor of ongoing commitment.

Decision makers also look for escalation. Did you start by splitting small bills and move to larger joint commitments? A clear timeline helps so show when accounts were opened, when the mortgage began, and when savings became joint. Explanatory statements that explain why you chose each arrangement are very useful.

More detail can include evidence of financial planning together, such as a shared budget, correspondence with a bank about joint products, or records showing one partner supported the other during unemployment for six months. These items show practical, ongoing support and help explain non-traditional arrangements.

Pros and Cons of Different Financial Arrangements

You do not need a single “right” way to manage money for a partner visa. Different arrangements create different strengths and gaps in evidence. I often see assessors respond well to clear, consistent records that tell a simple story—joint mortgage payments, shared rent, regular transfers or labelled payments can all be persuasive.

Look for patterns you can document. For example, 12 months of joint account statements showing rent and grocery payments is strong. Likewise, 18 months of regular transfers for half the rent plus a shared lease can also work. The key is clear, repeatable evidence that links you and your partner financially.

| Pros | Cons |

| Joint bank accounts give a clear transaction trail for assessors. | One partner may still control the money, which assessors may note. |

| Shared bills in both names show ongoing household cost sharing. | Bills only in one name need extra proof you paid them. |

| Joint property or loans demonstrate long-term commitment to each other. | Buying property can take years, so new purchases show less history. |

| Regular transfers between separate accounts show financial support. | Irregular or ad hoc transfers look weaker without explanation. |

| One partner paying most bills can still show strong support. | Large imbalances may prompt questions about financial independence. |

| Shared investments or superannuation entries add weight to your file. | Documentation for investments can be complex to explain. |

| Receipts for shared expenses (groceries, trips) build a practical story. | Small-value receipts alone rarely persuade without wider context. |

| Loans or debts in both names show mutual liability and planning. | Short loan histories give less time-based evidence of commitment. |

| Explanatory statements tie your evidence together and clarify roles. | Poorly written or vague statements add little to your case. |

| Consistent contributions to household accounts show day-to-day interdependence. | Informal cash arrangements are hard to prove without supporting documents. |

Advantages of Joint Finances

Joint finances create a straightforward paper trail. Bank statements that list payments for rent, utilities, groceries or mortgage repayments directly link you and your partner. I have seen decision makers favour accounts with 12 months or more of consistent joint activity.

Joint loans and property registrations are particularly powerful. If you co-own a property or have a joint loan for two or more years, that shows long-term planning. Even if one partner deposits more money, the shared liability and named ownership matter more than equal contribution.

Benefits of Maintaining Separate Accounts

Keeping separate accounts is fine when you can show ongoing financial connection. Regular transfers for rent, labelled payments for bills, or consistent support for shared expenses all make a strong case. I have helped couples who kept separate accounts but passed because they documented 12–24 months of steady transfers and joint bills.

Separate accounts can reflect cultural practices or personal preferences. What matters is that you explain the arrangement clearly. Provide annotated bank statements, a short joint budget, and an explanatory statement so assessors can follow how you support each other financially.

Practical steps help. Keep records of every regular transfer for at least 12 months. Label transfers with their purpose. Scan receipts for shared bills and keep a timeline showing how payments changed over time. If you can show transfers that cover 30–70% of rent for a year, that creates a persuasive pattern. I often recommend a short, signed statement from both partners that explains why you maintain separate accounts and how you split expenses.

Common Concerns and Solutions

Many applicants worry they won’t have “enough” financial proof. You don’t need every possible document. Decision makers want a clear story that shows you act as an economic unit, not a perfect set of joint accounts.

Focus on quality over quantity. Provide a few strong, linked items that explain your money life together. I have reviewed hundreds of files and seen simple, well‑explained evidence outperform piles of unrelated papers.

Fear of Not Having Enough Evidence

If you think your paperwork is thin, start by mapping one clear timeline of shared financial actions. List rent payments, shared bills, transfers, gifts, and joint purchases in date order. Attach one bank statement or receipt to each entry so an assessor can follow your story easily.

Use what you have: rent ledgers, utility bills, mobile plans showing the same address, and regular money transfers are helpful. Statutory declarations — a signed statement from a friend or landlord — can support claims about who paid what. In my experience, providing 6–12 months of consistent records and a short explanatory timeline often turns a shaky file into an acceptable one.

Addressing Unconventional Arrangements

Many modern couples split costs in non‑traditional ways. You might keep separate accounts but swap cash at the end of the week, use payment apps, or have one partner cover school fees while the other handles groceries. Document those patterns with screenshots, dated receipts, and clear notes about who paid and why.

Write a short, numbered explanation linking each piece of evidence to a specific claim. For example, state “We split rent: Partner A paid $700 on 1st of each month; Partner B transferred $350 weekly.” Then attach bank transfers, app screenshots and a signed declaration. The Migration Regulations consider financial aspects as one of four key areas, so make your financial story easy to verify.

Summing up

Now you should focus on showing how you and your partner function as an economic unit. Show shared spending, transfers, bills, receipts, or one partner supporting the other. Joint accounts help but are not required if you tell a clear financial story. Quality evidence that explains your real arrangements will carry more weight than lots of random papers. I’ve seen non-traditional setups succeed when applicants explain them well.

Now gather key documents, put them in a simple timeline, and add short statements that explain unusual arrangements. Ask witnesses for statutory declarations where helpful. Be honest about what you do, and get professional help if you want a stronger presentation of your finances.

Your shared financial evidence isn’t just paperwork—it’s a key part of telling your relationship story. With over 45 years of immigration insight, Carlos Sellanes and his team bring unmatched expertise to partner visa applications. If you want personalised advice to make your evidence stronger and your application more compelling, visit our website and connect with us today.

FAQ

Q: What financial documents should we include?

A: I recommend including joint bank statements, bills in both names, shared lease or mortgage, transfer records between you, joint investments, insurance policies, tax returns, and receipts showing shared purchases. These statements can be explained with short cover notes.

Q: Do we need joint accounts?

A: Joint accounts help because they show money flows, but they are not mandatory. I advise showing consistent transfers, shared bills paid by one partner, and clear notes explaining arrangements. Quality of evidence matters more than account names.

Q: How do we show financial support when one partner earns more?

A: Show bank transfers, receipts for rent and bills paid by the higher earner, written statements describing support, and periodic gift records. I often prepare a short timeline showing how financial support increased as the relationship developed.

Q: How far back should our financial documents go?

A: I usually advise providing at least 12 months of documents and up to 24 months if available. Provide a clear timeline of major shared expenses and accounts so assessors can see patterns over time and increasing commitment.

Q: What if we have cultural reasons for not merging finances?

A: Cultural practices are common and accepted if explained. Provide a clear statutory or personal statement describing your cultural approach, plus evidence like separate bills, transfers for household costs, and joint purchases showing mutual support.

Q: How should we label and organise our financial evidence?

A: Create an indexed folder with a short cover letter summarising each document. Label documents by date and type, add brief explanatory notes for unusual items, and include a one-page timeline linking documents to key relationship events.

Q: Can explanatory statements help with non-traditional financial arrangements?

A: Yes. Explanatory statements are powerful. I ask clients to describe who pays what, why arrangements suit them, and any informal support. Attach receipts and transfers and keep statements honest and consistent with your documents.

Author Bio

Carlos Sellanes is the founder and principal of Sellanes Clark Immigration Law Specialists, an Australian firm established in 2003. Carlos has more than 45 years immigration experience with over 20 years in practice and more than 25 years with Australia’s Department of Immigration where he gained unmatched insight into migration law and policy. Today, he leads a team recognised among the Top Ten Immigration Law Firms in the Asia-Pacific, offering expertise across skilled, family, and corporate visa categories. Through his blogs, Carlos shares practical updates and professional guidance to help clients navigate the complexities of Australian immigration with confidence. Learn more about Sellanes Clark Immigration Law Specialists.